|

Article ID: 38

Last updated: 30 Oct, 2019

How Do I Update my 2013 Federal Tax Tables?

If you subscribe to the FreightWare Payroll system you will need to update and maintain your tax tables annually or when there are changes to the schedule. Following are instructions on how to update your 2013 Federal Tax tables as well as updates to wage limits and rates for Social Security. State and Local Payroll Tax updates are the responsibility of each individual employer. If you need assistance in updating these please call support at (360) 896-6699 X 101 Following are the changes given in Notice 1036 issued by the IRS on January 3, 2013. There is every possibility that additional changes could be made. We will do our best to keep you updated. Think this is a pain? Write your congressman!!! 1. Married Federal Tables & Exemption Amount 2. Single Federal Tables & Exemption Amount 3. Employee Social Security Rate and Limit

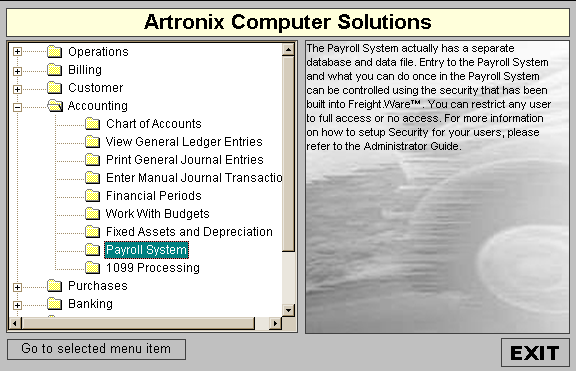

Select Main Menu > Accounting > Payroll System to launch the payroll system

Select the Taxes tab and then Employee Taxes

Select Federal Income Tax : Married from the drop down list in the upper left corner Adjust the exemption amount - The Exemption Amount for 2013 is $3900.00. Select the Tax Table Tab Adjust the From / To and Tax Rate percentages as illustrated for Married persons in 2013.

Select Federal Income Tax : Single from the drop down list in the upper left corner.

Adjust the From / To and Tax Rate percentages as illustrated for Single persons in 2013.

Select the tax type FICA Social Security Adjust the From / To and Tax Rate percentages as illustrated for FICA Social Security.

Select Done when finished to save your changes.

This article was:

Report an issue

Article ID: 38

Last updated: 30 Oct, 2019

Revision: 3

Views: 146

Tags

|

.bmp)